The Average New Car Payment Hits Record High As Americans Drown In Loan Debt

The numbers are in from LendingTree.com and they're not pretty for the average car payment for new vehicles in the United States. According to the online loan company, the average new car monthly payment now stands at $644, which is up nearly 12% over the prior year statistics. It's an even crazier jump for used vehicles, where loan payments are up 18% and 15% for leased vehicles.

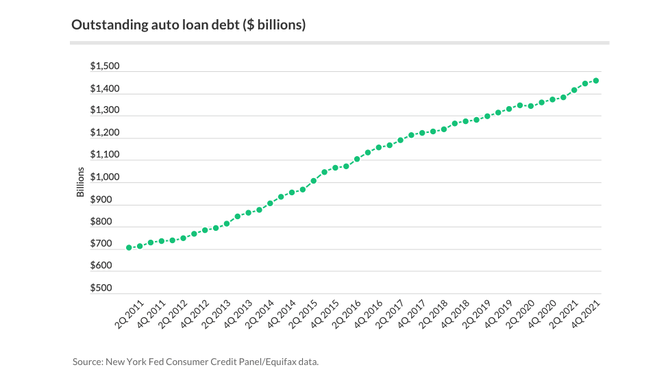

According to LendingTree's analysis of the latest statistics, Americans now owe a staggering $1.46 TRILLION in auto loan debt, which is the third-highest debt category behind home mortgages and student loans.

If the average monthly payment for a new vehicle isn't staggering enough, consider how long people are paying on their new cars. The average loan term right now on new vehicles is 69.7 months or nearly six years at $644.

That average monthly payment combined with the term of the loan equates to an average auto loan now checking in at nearly $40,000 for new vehicles and just under $28,000 for used vehicles. As you'd expect, this has led to more auto loan debt and the graphs don't lie.

Americans just keep taking on more and more auto loan debt and there doesn't appear to be anything stopping this runaway train.

Outstanding auto loan debt in the United States / via LendingTree.com

If there's good news here, it's that, according to Lending Tree's stats, auto loan delinquency rates have dropped to 5.3% from a peak of just under 11% during the economic crisis of 2009.

But Experian Automotive notes that in the fourth quarter of 2021, people started taking out loans that will last even longer than the average of six years. Experian found that 33% of auto loans originating in the fourth quarter were for 73 to 84 months.

That's right, 84-month loans. Those cars aren't being paid off until 2029. That's right, it's sobering.

Now add in rising fuel costs, 10% inflation in places like Atlanta, mortgages out of control, auto insurance rates that have shot up 20% in some states, including Texas, and you have yourself quite a situation.

As of early January, the average American owed $155,622 in debt and now, based on the Federal Reserve raising the benchmark interest rate, credit card rates will likely go up. Experts say the normal American won't notice the recent increase, but, the year is young.

“The big danger comes from this happening several more times over the next few months and potentially in bigger chunks,” Matt Schulz, chief credit analyst at LendingTree, told CNBC.