Report: U.S. To Ban Import Of Russian Oil & Gas

Bloomberg reported Tuesday morning that the Biden administration is set to impose a ban on the import of Russian oil along with liquefied national gas and coal. The U.S. decision, according to Bloomberg, will not include the participation of European nations that rely heavily on Russian oil and gas.

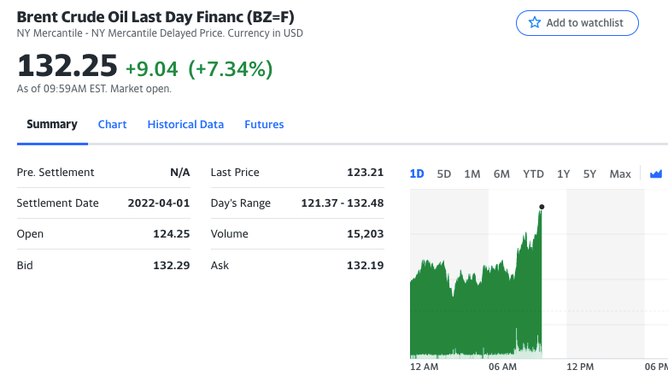

With gas prices already set to hit all-time record highs, this news from the Biden administration is expected to send oil even higher with JP Morgan predicting oil could reach $185 a barrel by the end of 2022, "if disruption to Russian exports last that long," Reuters reports.

Up first for the oil history books is the $147 per barrel mark that was set in July 2008. Brent crude nearly reached the $140 mark Monday as the war in Ukraine raged on and Biden's administration debated its next move with Vladimir Putin.

"A prolonged war which causes widespread disruption to commodity supplies could see Brent moving above the $150 a barrel mark," Giovanni Staunovo, commodity analyst at UBS, told Reuters.

Biden's administration now has to deal with national gas at all-time highs, fuel costs at all-time highs, inflation hovering at 7% and interest rates that are expected to rise this month.

As if that news isn't a big enough hit to the U.S. economy, it's also worth remembering that credit card debt in the fourth quarter of 2022 increased by $52 billion, which was the largest quarterly increase in credit debt going back 22 years.

U.S. household debt went up $333 billion in Q4 and debt balance -- mortgages, credit card and student loans -- was up by $1 trillion as people took on larger and larger mortgages and cars with huge price tags.

"The total increase in nominal debt during 2021 was the largest we have seen since 2007," Wilbert Van Der Klaauw, senior vice president at the New York Fed, told The Street.

For those keeping track at home:

• High inflation

• Rising interest rates

• High debt

• High natural gas prices

• High fuel prices